Who is Wave for?

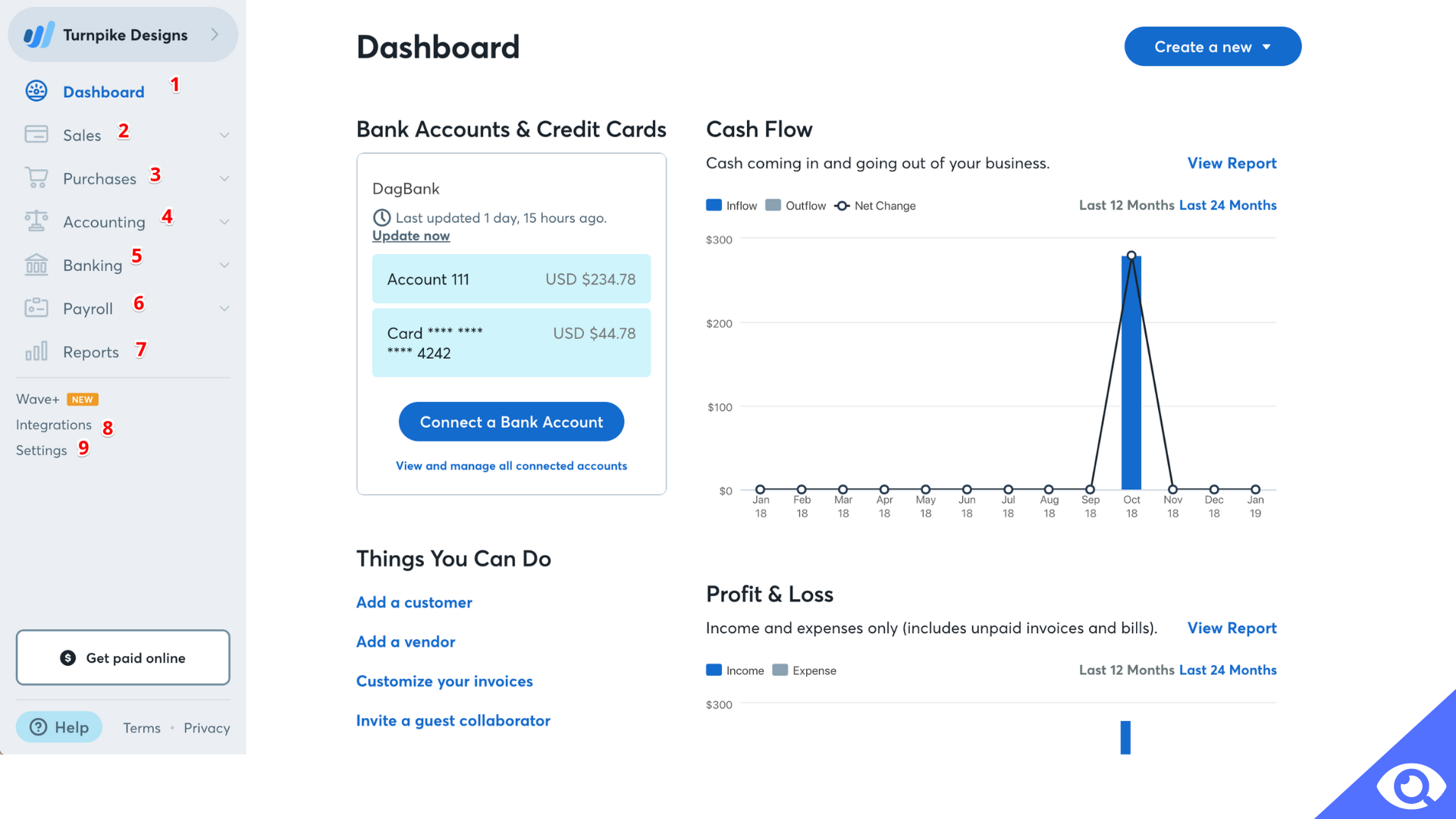

Wave was designed for freelancers, small firms, and sole proprietors. Accounting capabilities in Wave are absolutely free; therefore, you'll only pay for the application if you use Wave Payments or Wave Payroll. Wave is a suitable option if you intend to stay as the sole proprietor. However, if your business goals include growth, this might not be the best solution.

Who is FreshBooks for?

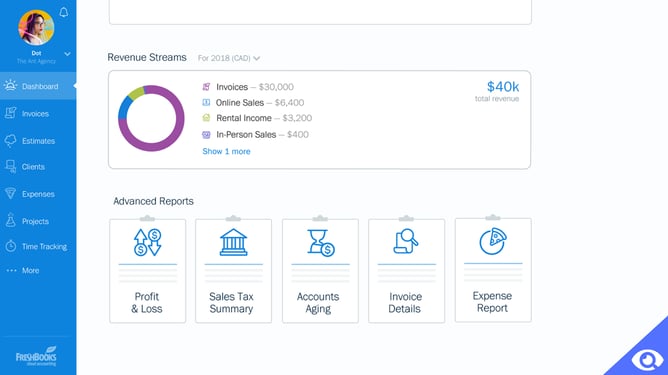

Like Wave, FreshBooks was created with the sole proprietor in mind, making it an excellent choice for service providers such as attorneys, architects, plumbers, designers, and anyone who works independently. However, with four plans available, FreshBooks can also be used by growing companies. Because of its simple and intuitive interface, FreshBooks is perfect for those entering the business world for the first time who know nothing about accounting.

Comparison Chart for Wave and Freshbooks

| Criteria | Wave | FreshBooks |

| Best for | Small companies with basic accounting needs | Businesses that require project accounting |

| Number of Users | Unlimited | 1 plus $10/month for additional users |

| Customer Support |

|

|

| Integrations | Slack, PayPal, Square, Stripe, Etsy, Google Sheets, HubSpot, Pipedrive | Zapier, Shopify, PayPal, Square, Bench Bookkeeping, Calendly, Mailchimp, HubSpot, Gusto, Stripe |

| Pricing | $0, plus additional fees for credit card processing and payroll |

|

Wave vs Freshbooks: Features

Now that we've taken a quick overview let's compare the two apps' important features to determine which one outperforms the other in various categories.

Invoicing

Wave includes a variety of templates, and you can choose how you want to invoice during the first setup. The program also assists in making regular invoices and keeping track of payments. Wave's templates are customizable, allowing you to add your own style to the invoice.

FreshBooks also makes it simple to create and send invoices. You can add a client to the invoice and edit other details such as the due date, company information, date of issue, and more. There are many templates that you may customize by changing the colors, fonts, logo, and headers. Invoices can also include terms, notes, and attachments. If you have a Plus or Premium plan, you can send payment reminders, add late fees, and make recurring invoices.

Winner

Both FreshBooks and Wave are good at invoicing, but FreshBooks provides more customization options. It offers more templates and features, such as the ability to customize payment reminders and late fees for various clients.

Revenue and Expenses

Within the Wave platform, you can manually record sales transactions or create and send invoices. When a client pays, you can mark the invoice as paid, and Wave will track your cash flow automatically. You can also connect your bank account or credit card to the software, which will automatically import transactions and categorize them into tax-friendly groups. Expenses can also be manually added. Wave's receipt scanning tool is useful, but you need a web browser to upload receipts because the mobile app does not support this feature.

FreshBooks tracks your earnings from invoices, but it also allows you to record income from other sources such as Etsy and Shopify. This functionality ensures that all of your revenue sources are accounted for. You can also create and modify expenses, generate expense reports, and schedule recurring expenses to be created automatically on a regular basis. You can upload receipts and keep track of business expenses in several currencies.

Winner

Although both programs have robust revenue and expense tracking capabilities, FreshBooks has a tiny advantage. The software allows you to assign expenses to customers, which Wave does not.

Project Management

FreshBooks includes a strong Projects feature that allows you to collaborate with clients and team members. You can assign projects to clients, create flat-rate or hourly projects, and tailor your projects to your specific requirements. Within a project, you can also share files, attachments, and comments. Furthermore, you can track time using a timer or log time manually. This allows you to see all time spent by you and your team members, as well as invoices and expenses related to a certain project.

Wave does not have project management tools.

Winner

FreshBooks wins this round since it is the only one of the two that has project management features.

Online Payments

Wave's native Wave Payments service is used for payment processing, which allows your customers to pay with major credit cards directly from the invoice. It also supports digital wallet payments through Apple Pay and recurring billing for customers on retainer. Credit card processing fees are 2.9% plus 60 cents per transaction, with a slightly higher rate for American Express at 3.4% plus 60 cents. Bank transactions include a $1 minimum fee and a 1% charge.

FreshBooks supports online payments via the payment processor WePay, which charges 2.9% + 30 cents per transaction. In addition, you can accept payments through Stripe and PayPal.

Winner

With its native Wave Payments option, Wave has a benefit in this category.

Payroll

Both Wave and FreshBooks provide payroll as an add-on service. FreshBooks collaborates with Gusto for payroll processing, with plans beginning at $39 + $6 per person per month.

Wave Payroll is a native full-service payroll solution offered in 14 states and Canada. Paid plans start at $40 per month, with an additional $6 for each active employee or independent contractor. Wave also offers self-service payroll starting at $20 per month, plus $6 for each active employee or independent contractor. With the self-service option, you have to handle payroll tax payments and filings manually.

Winner

Wave wins this round because it provides a native payroll solution, whereas FreshBooks relies on a third-party program to enable payroll.

Assisted Bookkeeping

Wave Advisors is a service that helps with bookkeeping, accounting coaching, and tax-related work. They can manage tasks, including organizing bank transactions, verifying bank records, and preparing for taxes. Bookkeeping services start at $149 per month, while accounting and payroll coaching are available for a one-time cost of $379.

FreshBooks does not provide bookkeeping support.

Winner

Wave takes first place in this category.

Reporting

FreshBooks has 14 standard reports with limited customization possibilities, including business health and double-entry accounting reports. You can export any report to Microsoft Excel for additional customization. Reports can also be saved as PDF files.

In comparison, Wave provides 12 reports. These contain financial statements, sales tax reports, accounts payable and receivable reports, and a trial balance sheet.

Winner

In this round, there is no clear winner because both programs provide a similar number of reports.

Wave vs Freshbooks: Support

| Support Options | Wave | FreshBooks |

| Chatbot | ✅ | ✅ |

| Email Support | ✅ | ✅ |

| Self-help Resources | ✅ | ✅ |

| Live Chat Support | ✅ | ❌ |

| Phone Support | ❌ | ✅ |

FreshBooks provides great customer service, where users can seek support through email or talk with a representative via a chatbot. One of the best things is that you can speak with a real person over the phone. Some companies, such as QuickBooks Online, offer a similar service, but you cannot initiate the conversation. With FreshBooks, you can call an agent directly without first submitting a ticket. It also provides a comprehensive online help section with step-by-step tutorials on how to use FreshBooks' features.

However, you cannot rely on Wave to assist you with serious or urgent technical issues. There is literally no one to speak with over the phone, and the only thing you have is chat support, which is provided to new users for 60 days after purchase. In addition to a chatbot, you can use the Wave Help Center, which includes some useful resources that will answer your problems.

Winner

FreshBooks has an advantage here because it offers phone support, whereas Wave offers chat and email.

Wave vs Freshbooks: Pricing

FreshBooks has four paid options that range in price from $17 to $55+ per month (Lite, Plus, Premium, and Select). FreshBooks includes one user in all plans, except the Select plan, which supports two users; extra members can be added at $11 per person per month. FreshBooks also offers other services, such as advanced payments ($20/month) and Gusto Payroll (starts at $39/month + $6/month per person).

Meanwhile, Wave's bookkeeping software is free and supports an unlimited number of users. There are additional fees for credit card and payroll processing, which is common for any bookkeeping tool. Wave may charge you the following fees:

- Accounting and Invoicing: Free

- Credit card processing: 2.9% plus 30 cents per transaction for most cards, 3.4% plus 30 cents per transaction for American Express

- Bank payments: $1/transaction

- Payroll:

- $35/month plus $6/employee or independent contractor for users living in tax-service states: Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin

- $20/month plus $6/employee or independent contractor for users living in the remaining 36 states

Winner

Your best pricing option will be determined by your needs and plans.

If you want to grow your business and require capabilities such as unlimited billable clients, FreshBooks may be a better alternative, as there are various pricing plans, each with additional functionality.

If you have a limited budget and require free accounting and invoicing software, Wave may be a better solution.

Wave vs Freshbooks: Integrations

FreshBooks integrates with hundreds of third-party applications to automate various business operations that are beyond its capabilities. Zapier, Shopify, PayPal, Square, Bench Bookkeeping, Calendly, Mailchimp, HubSpot, Gusto, and Stripe are some of its leading integrations.

Wave has few direct integrations, but it uses Zapier to connect with thousands of apps.

Slack, PayPal, Square, Stripe, Etsy, Google Sheets, HubSpot, and Pipedrive are among its well-known integrations.

Winner

FreshBooks wins this round because it integrates with more apps directly than Wave. The majority of Wave's integrations work via Zapier.

[Related Article: Xero vs QuickBooks]

Wave vs Freshbooks: Pros and Cons

Wave

Pros:

- Accounting software that is completely free to use.

- Simple setup instructions with an easy-to-use UI and app.

- Double-entry accounting includes a general ledger and a chart of accounts.

- It offers unlimited users, bank account syncing, and business management.

- Simple Wave Payroll integration.

Cons:

- Accounting features are limited.

- There is only one pricing plan (not scalable for growing businesses).

- Customer support is available only via email.

- Third-party app integrations are only available through Zapier (a subscription is required).

Freshbooks

Pros:

- Mobile app and user-friendly UI.

- Invoice features, customizations, and automation are excellent.

- Project management, time tracking, and expense tracking are all built-in.

- Customer service that is responsive and offers many contact options.

- There are over 100 third-party integrations, including Gusto and SurePayroll.

Cons:

- There is a high fee for additional users.

- There is no accountant access or double-entry accounting with the basic plan.

- Inventory management functions are limited.

- The number of billable clients is limited by the plan.

- There are far fewer third-party integrations than most competitors (particularly Xero and QuickBooks).

Alternatives to Wave and FreshBooks

QuickBooks Online

QuickBooks Online is a more scalable option than FreshBooks or Wave, with four plan tiers and the flexibility to support larger, smaller companies. The software includes a variety of features and add-ons, as well as integration with hundreds of apps, including QuickBooks' own payroll and payment processing software.

[Related Article: QuickBooks vs NetSuite]

Xero

Unlike FreshBooks and QuickBooks, Xero allows unlimited users in all of its plans, including the most basic. It provides an accountant certification program and integrates with over 1,000 small-business apps, including PayPal and Gusto.

Zoho Books

Zoho Books has a variety of capabilities, such as automated workflows and real-time project tracking. Its most expensive plan limits users to 15, but you can add more for an additional monthly cost. Zoho features a suite of accompanying software that connects with its accounting program, including customer relationship management, sales, and marketing tools.

Summary: Wave or Freshbooks?

Despite their different pricing models, FreshBooks and Wave share many features. FreshBooks may be a better option for small firms that expect to grow. However, Wave provides all of the tools and functionality required to manage your business for sole proprietors, freelancers, and micro-business owners.

(2).jpg)