Xero vs QuickBooks: At a Glance

Who is Xero for?

Xero is an outstanding accounting software solution for startups and small business owners, and it's especially well-suited for business owners who know nothing about accounting but still need to manage their finances effectively.

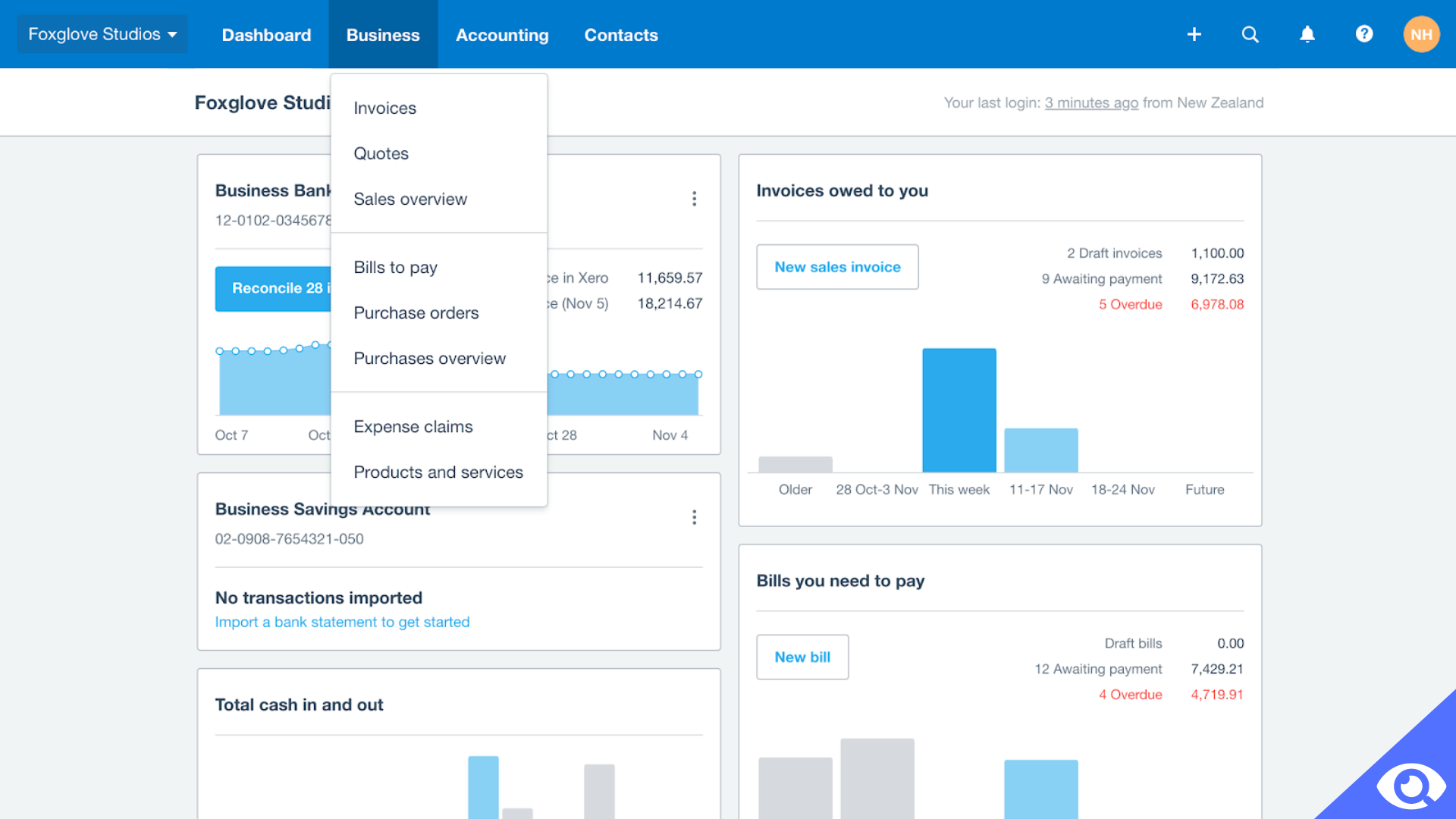

The Xero accounting interface is clean and simple, and novice users have access to a demo company where they can manipulate data without fear of accidentally adding or deleting critical information.

Who is QuickBooks for?

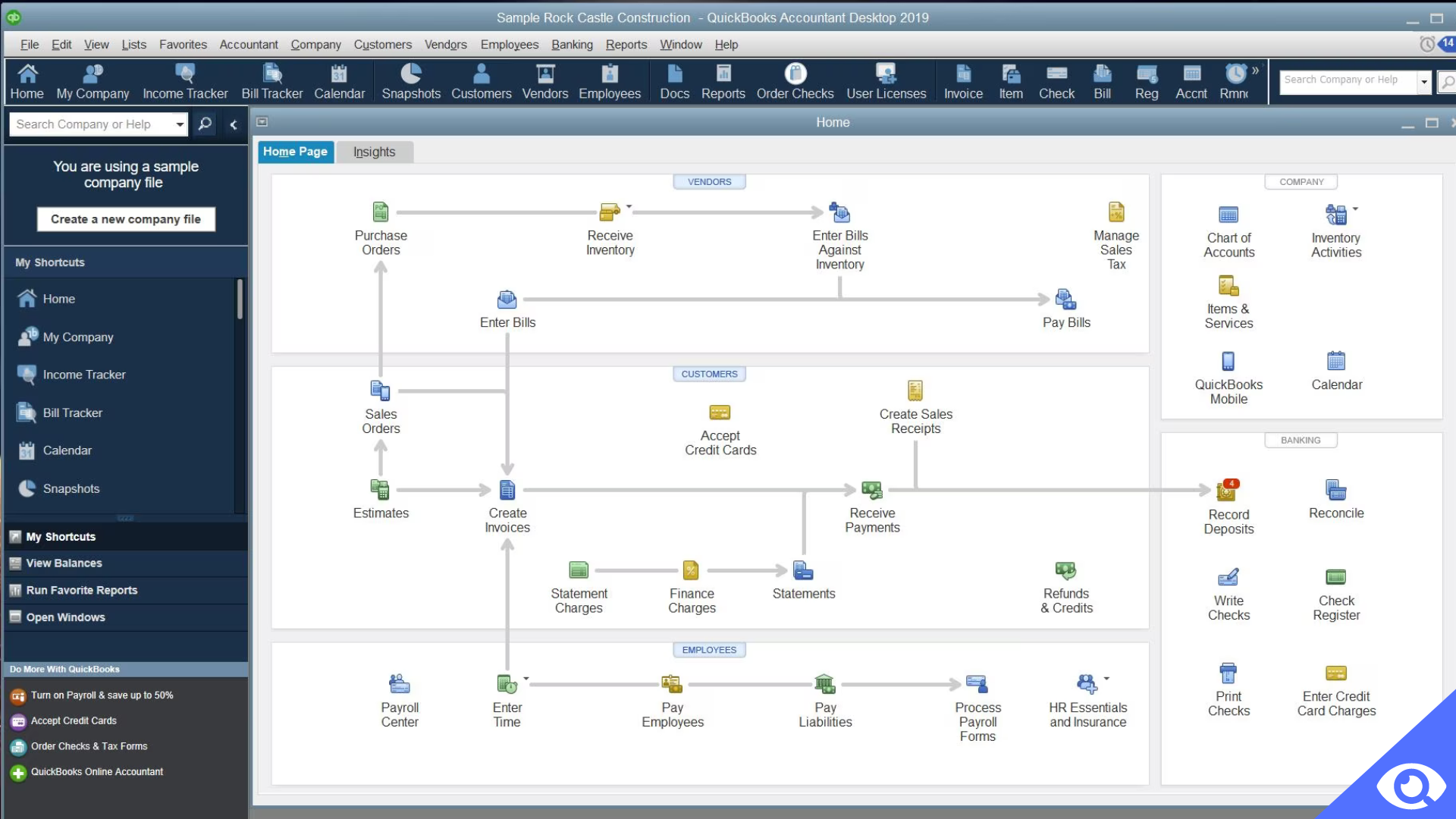

QuickBooks Online, an offshoot of the known QuickBooks Desktop application, is an excellent choice for small and expanding businesses.

Compared to the desktop version, QuickBooks Online was originally created for very small businesses, but it now gives growing businesses the option to use an application that they won't outgrow in a short time.

Xero vs QuickBooks: Comparison Table

| Parameters | Xero | QuickBooks |

| Overall Rating | ⭐ 4.4/5 | ⭐ 4.3/5 |

| Accessibility | Cloud | Cloud |

| Ease of Use | ⭐ 4.3/5 | ⭐ 4.2/5 |

| Customer Support |

|

|

| Integrations | Around 800 integrations, including: |

More than 750 integrations, including:

|

| Pricing | $13 to $70 | $30 to $200 |

| Free Trial | ✅ | ✅ |

| Mobile App | iOS and Android | iOS and Android |

Xero vs QuickBooks: Key Features

We compared Xero and QuickBooks in a variety of accounting categories and saw significant differences in bank reconciliation and fixed-asset accounting. Below is a full comparison of the two programs based on their features.

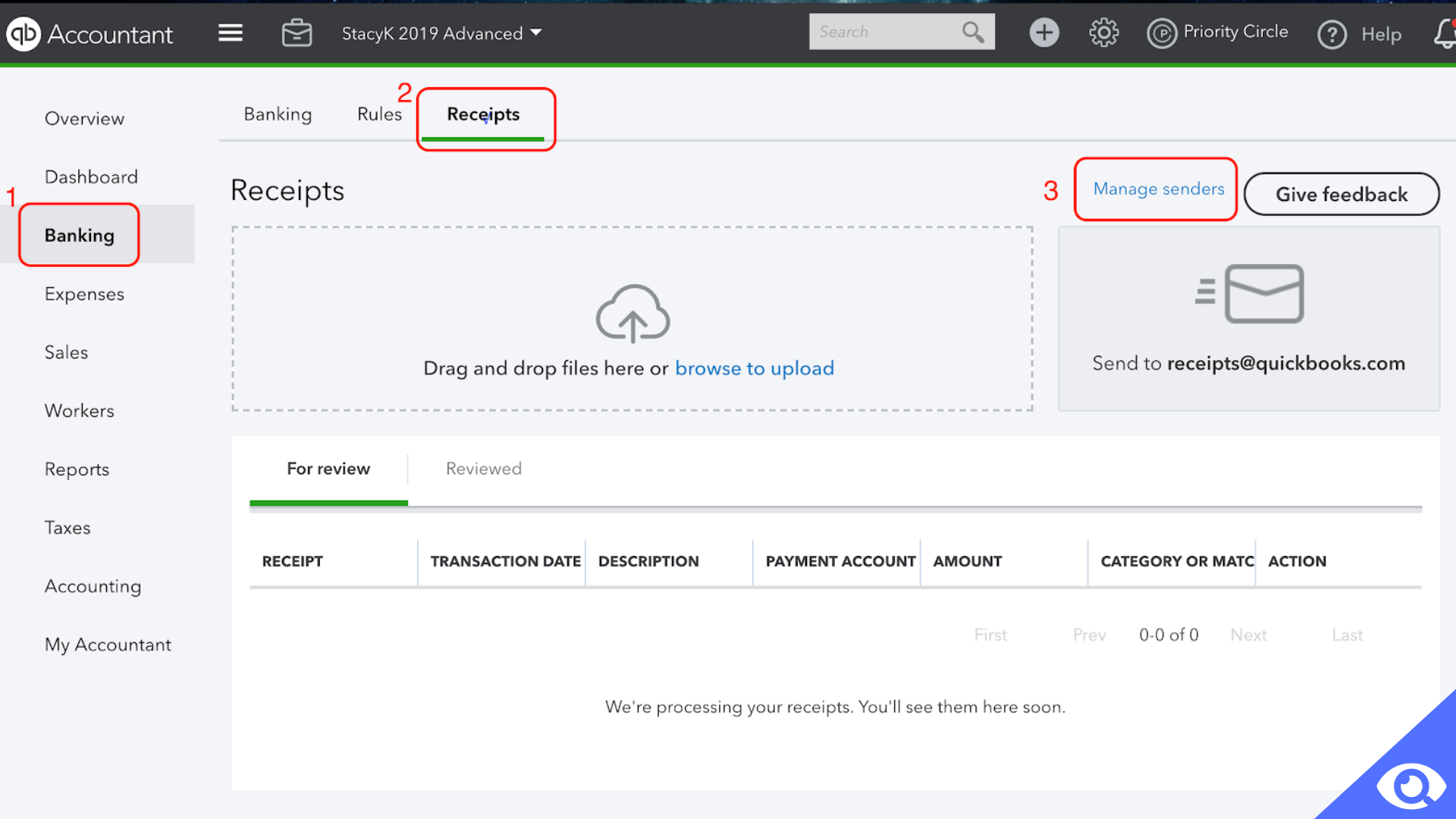

Banking and Cash Management

While both systems include bank reconciliation features, QuickBooks is more flexible because it allows you to reconcile a bank account by entering the ending bank balance and manually marking transactions that have cleared your bank. Another major distinction is that QuickBooks Online allows you to upload your transaction file instead of connecting your bank account. To reconcile your transactions with Xero, you must first connect your account.

Invoicing

In terms of invoicing, QuickBooks Online outperforms Xero with its robust features and customization options. One of the standout features of QuickBooks Online is its ability to automatically calculate sales tax rates based on the customer's address. This not only saves time for businesses but also ensures accurate invoicing and compliance with tax regulations.

The customization choices offered by QuickBooks Online are extensive, allowing businesses to present and maintain a professional brand image. Users can personalize their invoices by adding their company logo, choosing different color schemes, and customizing the layout. This level of customization helps businesses create professional-looking invoices that reflect their brand identity and leave a lasting impression on clients.

Moreover, QuickBooks Online offers a range of invoice templates that can be easily customized to suit specific business needs. These templates include pre-set fields for important information such as billing address, payment terms, and due dates. Users can also add additional fields or create custom fields to capture specific details relevant to their business.

Additionally, QuickBooks Online simplifies the invoicing process by automatically tracking when invoices are viewed and paid. Users can set up automatic reminders for overdue payments, ensuring timely collections and reducing the need for manual follow-ups. This feature helps businesses maintain healthy cash flow and improve overall invoicing efficiency.

With its comprehensive invoicing capabilities and automated tax calculations, it's no wonder that QuickBooks Online is considered the top invoicing accounting software. Whether you're a small business or a larger enterprise, QuickBooks Online provides the tools and flexibility needed to streamline your invoicing processes and enhance your brand image.

Accounts Payable

Both offer excellent accounts payable (A/P) features, although QuickBooks Online is slightly better due to the ability to generate recurring payments. Xero allows you to create recurring bills but not payments, which means it does not charge your checking account automatically.

Project Accounting

You can use both Xero and QuickBooks Online for project accounting, but Xero may be better if you want a more precise choice to track your profitability. In contrast to QuickBooks Online, it allows you to compare estimated and actual project costs, which is essential for budgeting.

Fixed Assets Management

In terms of fixed asset accounting, Xero outperforms QuickBooks Online. QuickBooks Online allows you to record a fixed asset purchase, but it does not allow you to track your fixed assets or calculate depreciation.

However, Xero's fixed asset manager is really excellent. It enables you to record the purchase of a fixed asset and then calculate depreciation. You can also define asset types and provide each asset with an account ID. When you sell an asset, the software calculates a profit or loss. If fixed assets are a crucial aspect of your business, Xero is the right solution for you.

Inventory Management

Both Xero and QuickBooks Online are excellent at inventory accounting and automatically calculating the cost of your inventory sold. However, inventory accounting is included in all Xero plans, but QuickBooks Online only includes it in the Plus and Advanced versions. So, if you're looking for a low-cost inventory management system, consider Xero.

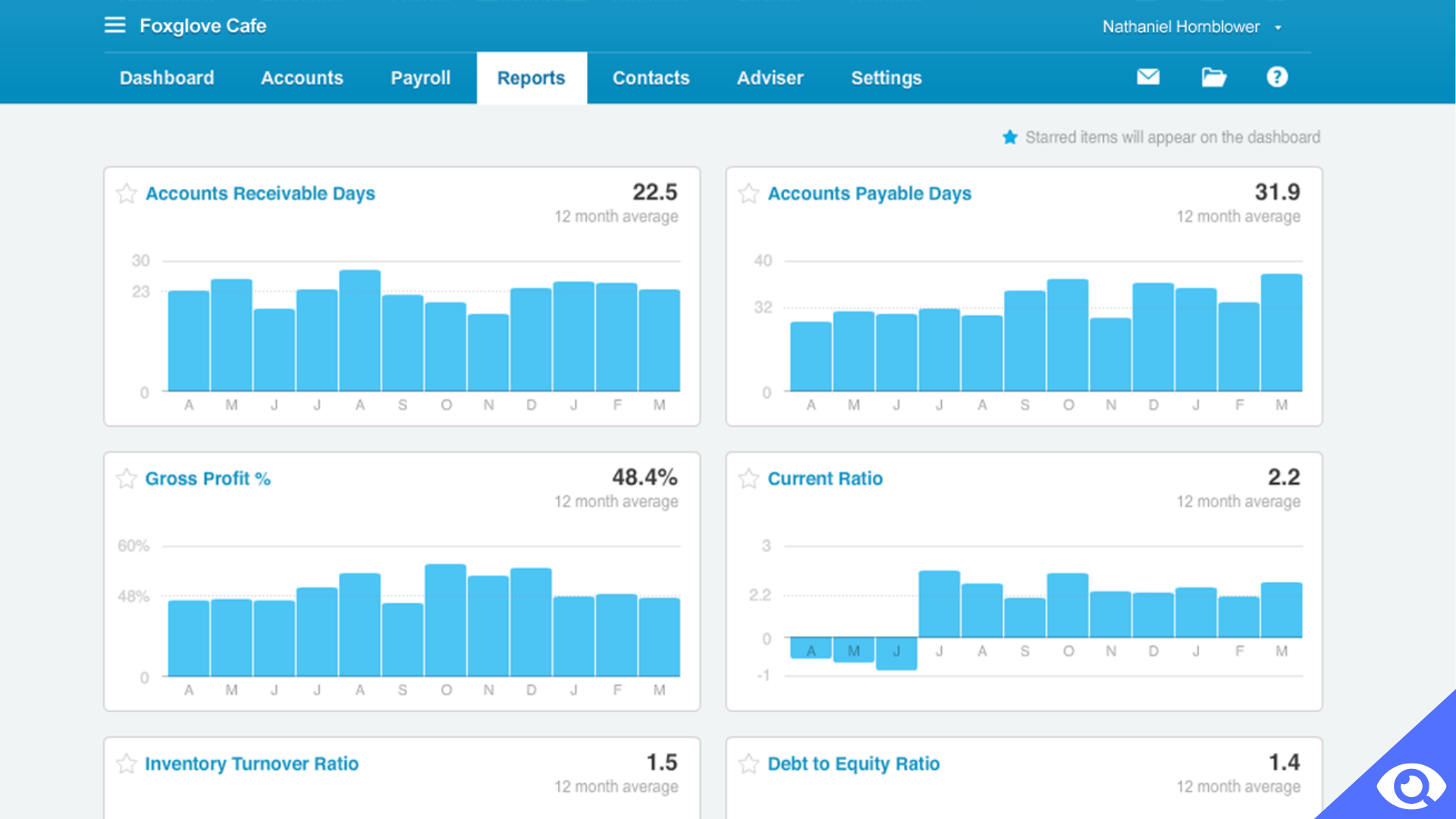

Xero vs QuickBooks: Reporting and Dashboard

Both QuickBooks and Xero provide excellent reporting features, with more aesthetic than functional differences: QuickBooks, for example, has a vertical sidebar for categories, while Xero has a horizontal one.

QuickBooks includes a main dashboard that may be customized with a series of tile-like graphs or lists that provide real-time KPIs at a glance. A bar graph of invoices can show which ones have been paid, deposited, or remain unpaid; a pie chart of expenses can break down travel, rent, and meal costs over the past month; bank accounts and sales can be followed, while income can be matched against losses. Meanwhile, a vertical sidebar can take you to more detailed dashboards on topics such as Workers, Taxes, and Reports. QuickBooks also provides a variety of customized reports, such as QuickBooks reports for nonprofits, which allow companies to track donations and finances with a single application.

Xero's main dashboard doesn't rely on tiles but instead allows for customization to display crucial statistics such as your business bank account balance over the past few days, a bar chart showing total cash flow from the previous week, or a chart displaying outstanding invoices. More specific categories like Business, Accounting, Payroll, Projects, and others have their own dedicated dashboards accessible through a horizontal sidebar. By clicking on any data, you can access a comprehensive breakdown with historical context, and you have the option to set up data tracking for the automatic generation of specific reports.

Statements of Cash Flows

Xero and QuickBooks both include tools for tracking cash inflows, cash outflows, and total cash in hand.

QuickBooks also provides a QuickBooks Cash account, which offers banking within QuickBooks, with 1% APY interest. Managers can also forecast cash flow estimates on a monthly and quarterly basis. QuickBooks' cash flow reports are more flexible than Xero's: Reports can be created using both direct and indirect methods, rather than only direct.

Xero's financial reporting tools start with interactive reports and budgets, which are updated in real-time throughout the week. When you require additional information, you can jump to detailed transactions and define specific KPIs. Reports can be customized using different columns, formulas, text blocks, and drag-and-drop accounts.

Xero vs QuickBooks: Customer Support

All software issues can be really frustrating, and you'll need the help of product support to address them. While each of these accounting systems includes a wide range of help articles, knowledge bases, and robust user communities, Xero and QuickBooks have their own support options. Let`s take a closer look!

Here is a list of Xero's customer service support options:

- Product training

- Help articles

- Knowledgebase

- Email support

- User guides

- In-product help

- User community

Because Xero's accounting features are really easy to use, these resources will be enough if and when something goes wrong.

QuickBooks Online provides the following support options:

- Product training

- Knowledgebase

- Help articles

- In-product help

- User community

- Get in touch with a support agent through email

- Get in touch with a support agent through messaging

- Get in touch with a support agent through a callback

You'll rarely be asking yourself how to use QuickBooks Online because the application provides plenty of guidance throughout; users may click on the question mark if they need help.

Xero vs QuickBooks: Integrations with Other Apps

Xero provides much more third-party integrations and extensions than QuickBooks. The Xero App Marketplace includes over 800 apps and is constantly introducing new ones in categories such as CRM, invoicing, inventory, time tracking, e-commerce, and others. Xero also has ten in-house apps that allow you to access its functionality on your mobile device.

QuickBooks is also a good competitor. It has its own App Store where you can get integrations with payment services like PayPal and Square, as well as time tracking apps like Google Calendar and QuickBooks Time.

However, if your company relies heavily on other software services, Xero is a better bet than QuickBooks for ensuring that everything works together and is easily accessible.

Xero vs QuickBooks: Pricing

Xero is less expensive and more scalable than QuickBooks because all subscriptions include unlimited users. If you have a small business and only need to organize and monitor a few bills and invoices, Xero's Early plan may suit you. However, if you work with several vendors and clients and require more advanced features, you should consider QuickBooks Online Plus.

| Criteria | Xero | QuickBooks Online |

| Price (monthly) |

|

|

| Number of users | Unlimited |

|

| Free trial | Yes | Yes |

Xero vs QuickBooks: Scalability and Suitability for Various Business Sizes

As mentioned before, QuickBooks is an excellent low-cost option for freelancers and small businesses, but Xero is popular with expanding startups. But what about larger companies and enterprise-level businesses?

Xero serves somewhat more mid-market businesses with 51-1000 employees than QuickBooks Online. For larger enterprises and enterprise-level companies that require greater transparency, power, and insights into sales margins, a better alternative will likely be a more comprehensive accounting system or ERP.

As a larger company, you can also consider Intuit's wider software suite, which includes QuickBooks Enterprise Solutions, which claims to have 6x the capacity of other QuickBooks editions. The Enterprise edition allows up to 30 users, supports up to 1 million list items, and provides advanced reporting, inventory, and printing.

[Related Article: Zoho Books and QuickBooks]

Xero and QuickBooks Alternatives

If you're looking for accounting software, you might be feeling overwhelmed by all of the alternatives. While Xero and QuickBooks are quite popular, they are not the only choices. There are also more accounting software solutions that can provide important features and a user-friendly interface.

Wave Accounting

Wave Accounting is a free accounting program for small service organizations, contractors, freelancers, and consultants. If you can't justify paying for QuickBooks Online or Xero, or if they have too many capabilities that your company does not require, Wave could be a good alternative. It includes similar invoicing functions, but no audit trail and no integration with third-party programs.

Zoho Books

Zoho Books offers plans for most budgets, with a free plan and paid plans starting at $20 per month. Higher-tier plans provide unique features such as workflow rules, in addition to tools that assist you in measuring project profitability. All paying users have access to phone and live chat assistance 24 hours a day, seven days a week, however, third-party integrations are limited when compared to QuickBooks Online and Xero.

FreshBooks

FreshBooks is one such solution that has increased in popularity in recent years. It is tailored to small businesses and includes invoicing, time tracking, and expense management. All plans include time tracking and phone assistance is available Monday through Friday from 8 a.m. to 8 p.m. ET. The first two plan tiers limit billable clients, but not on invoices.

To Sum Up

Both Xero and QuickBooks are excellent accounting software choices for small businesses. They both have a robust feature set, an easy-to-use interface, and competitive pricing. QuickBooks is a popular choice for businesses that prefer desktop accounting software and rely on the expertise of a bookkeeper or accountant to handle their financial tasks. With its comprehensive reporting capabilities and customizable dashboards, QuickBooks provides businesses with a powerful tool to manage their financial data effectively. The vertical sidebar and tile-like graphs offer a visually appealing and intuitive user experience.

On the other hand, Xero is well-suited for companies that require online accounting software with the flexibility to grow and adapt to their changing needs. With unlimited users included in all subscription plans, Xero is a cost-effective option for expanding startups and businesses with multiple team members needing access to the accounting system. The ability to customize the main dashboard and access dedicated dashboards for specific categories like accounting, payroll, and projects provides users with a tailored view of their financial data. Xero's real-time updating of reports and budgets ensures that businesses have the most up-to-date information to make informed decisions.

In summary, both Xero and QuickBooks offer powerful accounting solutions for small businesses, but their suitability depends on the specific needs and preferences of the business. QuickBooks excels in desktop accounting software with comprehensive reporting, while Xero is ideal for businesses looking for online accounting software with unlimited user access and scalability. Ultimately, businesses should evaluate their requirements and choose the software that best aligns with their goals and workflows.

.png?width=140&height=140&name=Noah%20(1000%20x%201000%20px).png)